Quick note on yesterday’s historic unveiling of the draft of Schumer’s comprehensive cannabis reform.

As discussed, it was a giant step forward but just one step nonetheless in what we expect will be a prolonged incremental process.

And while passerby’s and casual observers sold the news on scary headlines…

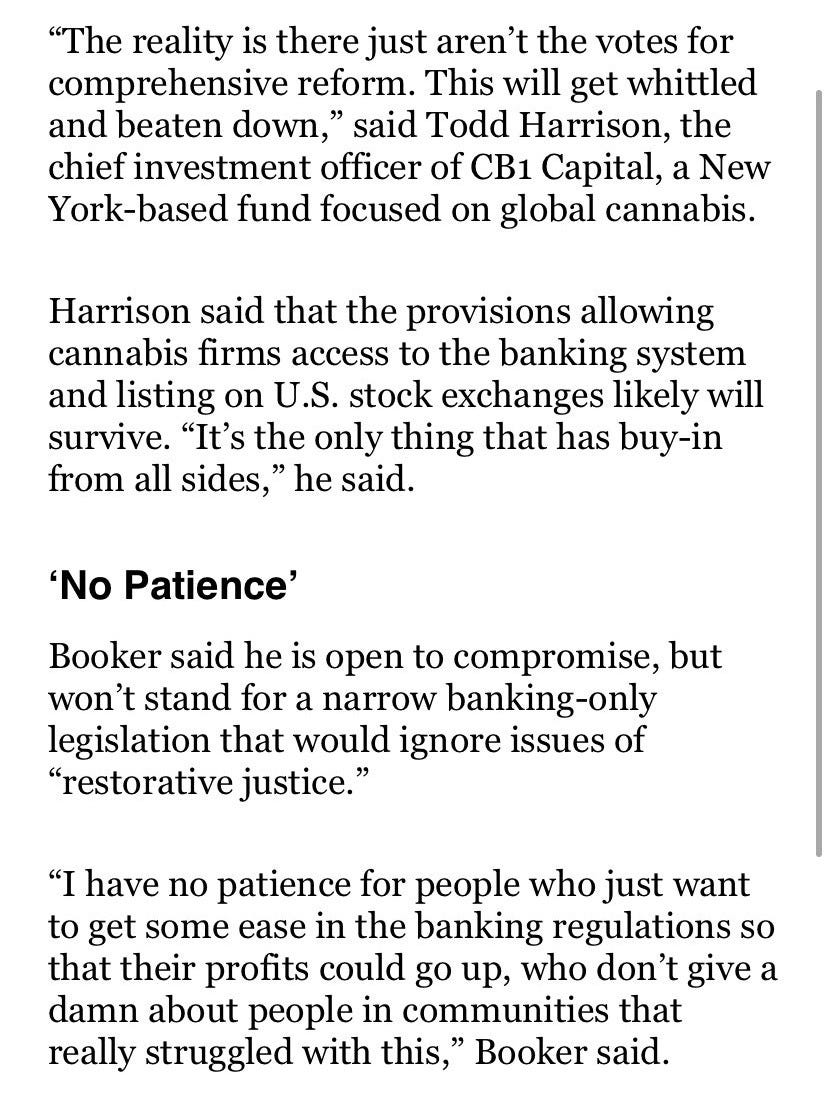

*SCHUMER BILL CALLS FOR FDA TO REGULATE CANNABIS

*BOOKER SAYS HE OPPOSES DOING JUST BANKING PORTION OF POT BILL

*SCHUMER SAYS DON'T HAVE VOTES NECESSARY FOR MARIJUANA BILL

*BIDEN POSITION ON CANNABIS UNCHANGED; NO NEW LEGISLATIVE ENDORSEMENTS COMING; PRESS SEC

…anyone who’s been paying attention was super-psyched to check this box.

And to be clear, we support all things criminal / restorative justice…

…and while we would prefer the legislation to look more like “Social Equity+” w the “+” for banking (vs. the other way around) we are pragmatic / realistic about what is doable / when at the federal level (Connecticut took five years w/o trillions of future dollars at stake) and we will again stress that this is a state-led story.

Bottom line (and again); Schumer doesn’t have 50 much less 60 votes and we don’t expect the NY / NJ (Booker) senators to return home to their respective social justice programs w/o functional banking bc it hurts smaller operators more than the larger players who’ve already navigated this torrent of regulatory treachery (and still make bank while driving the fastest growing industry in America).

[SMH on why MSO’s are perceived as “bad guys” by some; not only do they give back as they go, the reality is w/o the large operators, this economic / employment engine doesn’t get off the ground; not to mention having the foresight to prosper and being rewarded for taking risk is as American as America gets, and these are the pioneers.]

What Now?

Our sense is the sloppy price action was attributable to a few factors, not the least of which were anxious retail holders who were waiting for this news—waiting for a rally after the prolonged drawdown—to lighten / reposition. Given the liquidity wasteland that is our space—by design w US retail blocked (RH) + most HF / all institutions shut out (Pershing, BAML, WFC, CS, UBS…)—it doesn’t take much to push ‘em around.

When you combine a thin tape + one-sided positioning + hope against hope + jolting headlines + the reality that so few people understand that most of the verbiage is political posturing / gamesmanship / part of a painful albeit expected process that’ll spit out incremental change this fall / spring—and fewer people understanding that the longer it takes, the better it is for the incumbents—well, welcome to my world.

[yes it sucks more for those in prison / impacted in a more profound way but that’s not up to us if the votes aren’t there]

But don’t take my word for it, ask some of the smartest U.S. Cannalysts on the street:

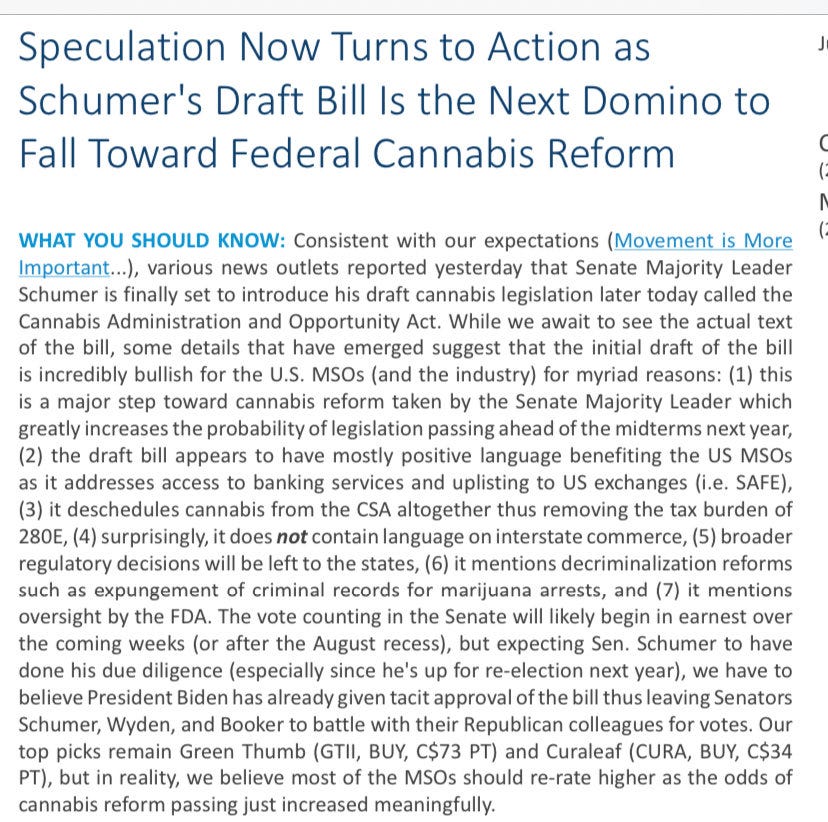

BTIG, who’s been Iron like a Lyon in Zion…

Not once, but twice…

Andrew Partheniou @ Stifel GMP:

Our homies who are down w AGP (Alliance Global Partners)…

Michael Lavery @ the pied Piper…

Pablo @ Cantor…

Scott (gonna make you a) Fortune @ Roth…

The M&M boy @ Needham….

You get the drill… and while this is gonna take time, we’ll continue to lean against the fundies as we’re playing long ball on the U.S side of our investment thesis.

Finally, our CB1 Capital June LTI dropped this morning and sharing is caring so…

Thank you; good luck.